Arts of Asia Editorial

Arts of Asia Calendar

View More

The Gustav Klimt Sale

Location: Auction house im Kinsky, Freyung 4, 1010 Vienna, Austria

Open 24 April, 2024

Until 24 April, 2024

The Smart Museum of Art, University of Chicago — “Meiji Modern: Fifty Years of New Japan”

Location: 5550 S. Greenwood Ave., Chicago, Illinois 60637, USA

Open 21 March, 2024

Until 9 June, 2024

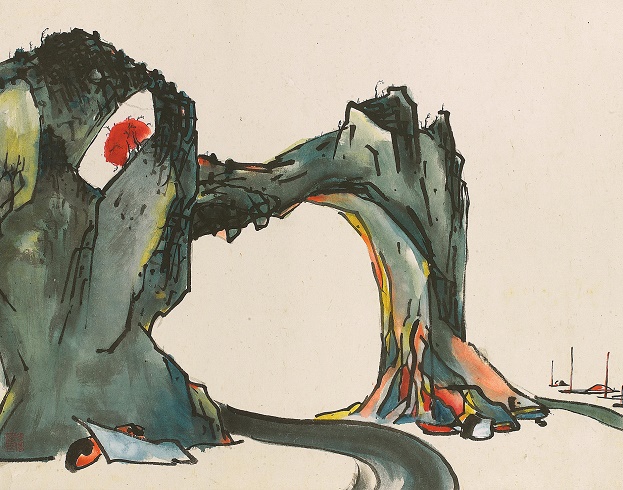

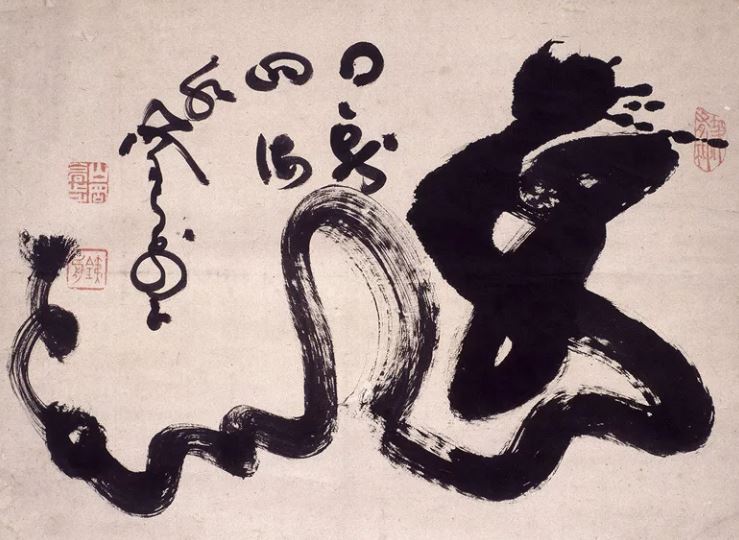

Japan Society — “None Whatsoever: Zen Paintings from the Gitter-Yelen Collection”

Location: 333 East 47th Street, New York, NY 10017, USA

Open 8 March, 2024

Until 16 June, 2024

Rubin Museum of Art — “Masterworks: A Journey through Himalayan Art”

Location: 150 West 17th St., New York, NY 10011, USA

Open 1 January, 2024

Until 6 October, 2024

HKMoA — “Art of Gifting: The Fuyun Xuan Collection of Chinese Snuff Bottles”

Location: Hong Kong Museum of Art, 10 Salisbury Road, Tsim Sha Tsui, Kowloon, Hong Kong

Open 12 April, 2024

Until 1 December, 2024

The Met — “Embracing Color: Enamel in Chinese Decorative Arts, 1300–1900”

Location: The Metropolitan Museum of Art, 1000 Fifth Avenue, New York, USA

Open 4 July, 2022

Until 4 January, 2026

Purchase Back Issues

Back Issues Published in 1970s

See the availability of Back Issues Magazine from 1970 to 1979.

Back Issues Published in 1980s

See the availability of Back Issues Magazine from 1980 to 1989.

Back Issues Published in 1990s

See the availability of Back Issues Magazine from 1990 to 1999.

Subscribe to Arts of Asia

For Connoisseurs and Collectors of Asian Art

Subscribe

Subscribe Arts of Asia Calendar

Arts of Asia Calendar Arts of Asia Links

Arts of Asia Links Gift

Gift